Overview

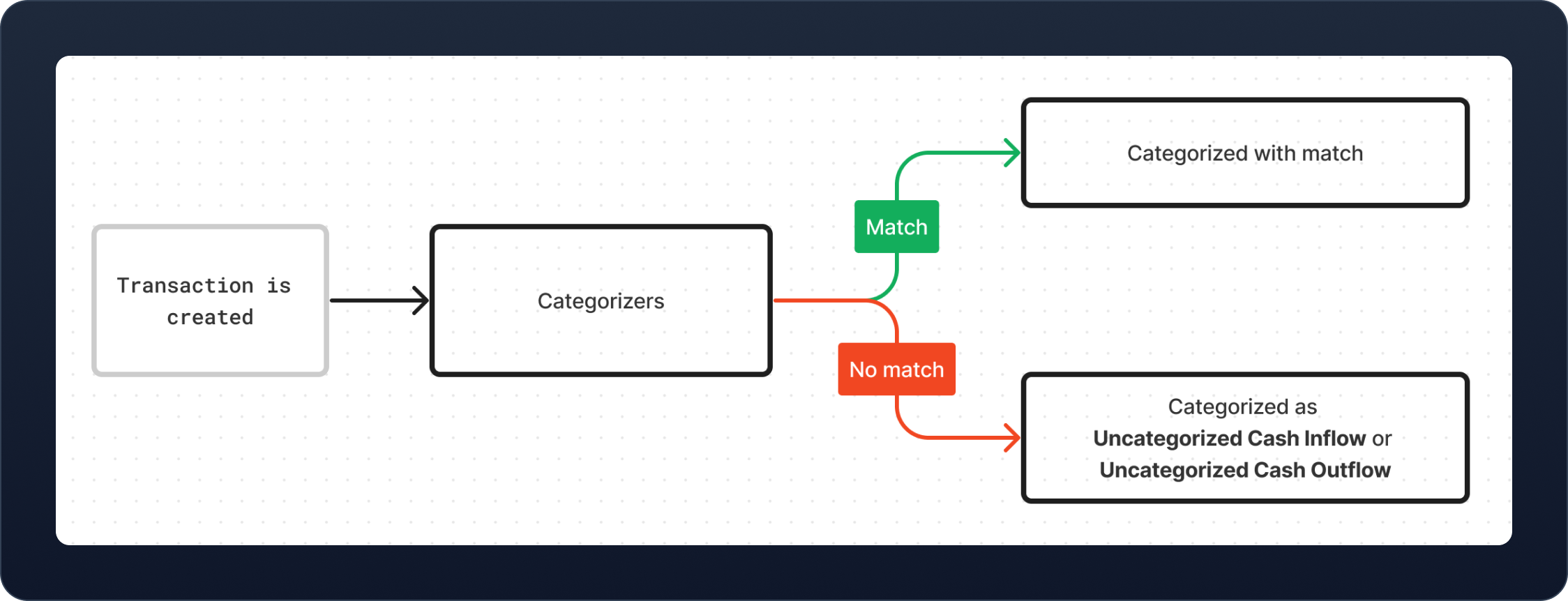

Categorizing transactions is the process of assigning accounting ledgers to real-world transactions. It is a core accounting process and ensures that a user’s accounting entries accurately reflect their business. Teal uses a customizable pipeline to automate transaction categorization, aiming to reduce the need for manual input from your users. Sometimes, our pipeline does not have enough information to categorize a transaction, and it will be categorized into either the “Uncategorized Cash Inflow” or “Uncategorized Cash Outflow” ledger. Configure your platform’s auto-categorizer in the developer portal.Auto-categorization pipeline

- Transfers between accounts

- Similarity checker

- Categorization rules

- AI Categorization

If one of these steps selects a ledger from the instance’s chart of accounts, the transaction will not be checked against the later rules. For example, transactions identified with the Transfer Between Accounts step, it will not be tested against platform rules or the similarity checker.

1. Transfers between accounts

The transfers between accounts step recognizes when a transaction is a transfer of funds between two financial accounts. This works by looking for a transaction in another financial ledger that is of an equal and opposite amount within a 7 day window. If such a transaction exists, it assumes that these are matching transfers and creates two journal entries, one for the cash inflow and one for the outflow. This step can only identify matching transactions after both the cash inflow and outflow exist in the system. If you or your user know that a cash outflow is a transfer between accounts before the corresponding inflow has been received, you can manually categorize the line entry to the Transfers Between Accounts ledger — a special ledger that exists in all chart of accounts templates — and the system will automatically categorize the corresponding inflow when it arrives.2. Similarity checker

The similarity checker looks for transactions that an Instance has manually categorized with a similardescription and applies the same category.

Over time this step becomes more effective as an Instance categorizes more of their transactions, improving the overall efficiency of the auto-categorizer.

3. Categorization rules

Categorization rules enable Instances and Platforms to automatically categorize a transaction. For platforms, this is useful if you are familiar with your customers’ spending and can help reduce the amount of time they spend manually categorizing transactions. For example, you might create a platform rule that puts every transaction with the description “UNITED AIRLINES” into the “Travel Expenses” ledger. Instances may use categorization rules to handle specific cases where a platform’s rules might not make sense given their chart of accounts. For example, if there is a platform-level rule to categorize “UNITED AIRLINES” transactions as “Travel Expenses”, but the Instance wants it categorized into a “Flights Expenses” sub-ledger, they could create a rule to do so. Categorization rules check transactions using an expression and priority. If a transaction matches multiple rules, the one with higher priority is selected. Categorization rules set at the platform level will apply to every transaction, regardless of instance, on your platform.Instance-level rules will always take priority over Platform-level rules.